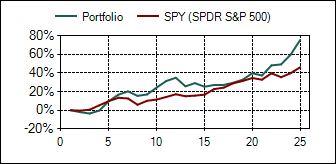

The last two years have been good for the overall market through this period, but many investors could have opted for a selection of individual stocks that could have beaten the market as represented by the S&P 500 (SPY), yes they would have taken a risk, but could have reduced that risk by investing in great businesses. Two years ago I felt these five companies were at the leading edge and would most likely be able to outperform the Index. In these two years these Five Greats are still leading companies with only Apple (AAPL) starting to show slowing sales growth. Below are the performance numbers of the Five Greats compared to the S&P 500. All total returns include dividends reinvested.

Amazon (AMZN), $364.03: Total Return of 70.5%

Apple (AAPL), $522.70: Total Return of 32.8%

Google (GOOG), $1,030.58: Total Return of 73.9%

MasterCard (MA), $717.10: Total Return of 107.8%

Under Armour (UA), $81.15: Total Return of 92.3%

Total Return of the portfolio for this period is 75.4%.

Total Return for the S&P 500 for this period is 46.2%.

Charts and stats courtesy of low-risk-investing.

Once again, Apple continues to lag the market and is really the only chink in the Five Greats portfolio. The company is just not growing revenues and earnings as fast as the other four Greats. Will this continue? Only time will tell. Even with lackluster performance from Apple I continue to have confidence in The Five Greats going forward.

Disclaimer: All articles are written as an opinion of the writer or writers. The contributors on this website are not professional investment advisors. These articles are written to share investing ideas that may be of interest to the reader. Always seek the advice of a professional investment advisor before investing.

Subscribe to Access Not Denied! by Email

Joe, it looks like the best just keep getting better. Quality . . .

ReplyDelete